I. Outline

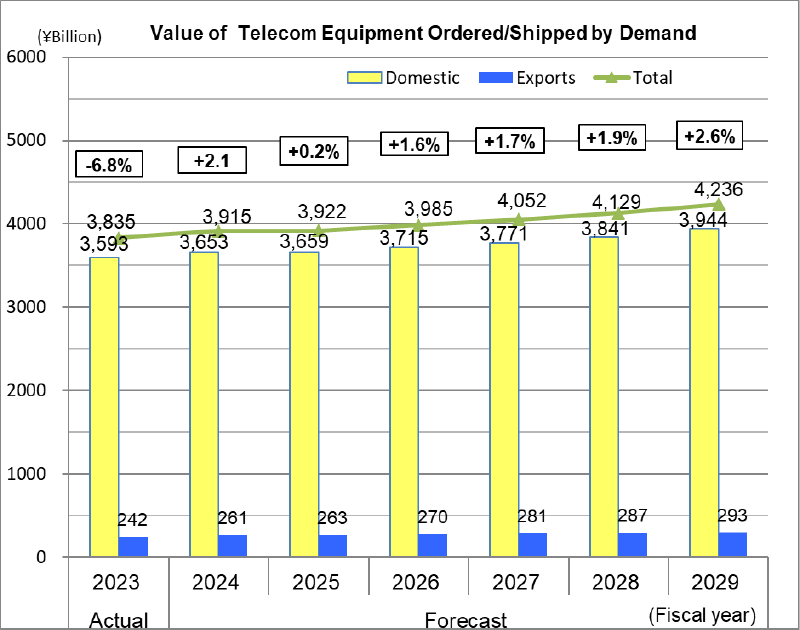

The Japanese economy in FY2023 showed signs of recovery from three years of the COVID-19 pandemic (hereafter referred to as COVID-19). In the telecommunications market, the widespread use of cloud services and web conferencing led to the upgrading of large-capacity/high-speed communication networks, expansion of or construction of new data centers translating into demand for Internet equipment. However, the weaker yen and rising parts and component costs pushed up the price of mobile handsets (with public phone line), and combined with longer replacement cycles or reluctance to purchase new handsets, kept growth figures flat. Weak appetites for capital investment among telecom carriers was evident from infrastructure equipment figures and the re-shaping of voice communications within the backdrop of changes in workstyles, pushed down demand for office-use equipment as well. In total, the total demand for telecommunication equipment for FY2023 was approximately 3.835 trillion yen (-6.8% year-over-year growth from the 4.114 trillion yen in FY2022).

Consumer spending headed towards gradual recovery in Japan, with the rise in actual wages and capital expenditure is also expected to grow in FY2024. The rise in the cost of parts and components is pushing up the unit price of equipment, while remote work and video streaming services are resulting in greater demand for high-speed, large capacity data traffic. Although several equipment categories are impacted by some overseas telecom carriers holding back on investments, the end to the shortage of semi-conductors has led to the projection of overall growth for exports. Total demand for telecom equipment in FY2024 is forecast at approximately 3.915 trillion yen (+2.1% year-over-year growth).

Changes impacting the ICT industry in Japan include diminishing global competitiveness, concerns over economic security and geo-political risks in the supply chain. Within this backdrop, Japanese brands manufacturing and selling telecommunication equipment lost market share to foreign brands with no end in sight to the shrinking of sales and profits. The imminent challenge will be how to embed Japanese technologies into the social fabric to tackle Japan’s social problems, such as the aging society, collaborate with numerous stakeholders – including government agencies and telecom carriers, and provide solutions applicable on a global scale. CIAJ will play its part in bringing together the strength of Japanese innovation to realize a home-grown world-leading Japanese ICT industry that is not just an extension of existing network technologies, but a blending of virtualization, ultra high-speeds, AI/IoT and other state-of-the-art technologies. The total telecom equipment market value is expected grow to approximately 4.236 trillion yen in FY2029, or an increase of 10.5% over the FY2023 figure.

II. 2024 Forecast

The total telecommunication equipment market figure for FY2024 is forecast at approximately 3.915 trillion yen (+2.1% over FY2023), with the domestic market accounting for about 3.653 trillion yen (+1.7% over FY2023), and exports accounting for 261.1 billion yen (+7.9% over FY2023).

Major Equipment Categories Forecast to Grow over FY2023 (In order of yen value growth)

| 【FY2024 forecast】 | 【Increase over FY2023】 | 【Rate of growth】 | |

|---|---|---|---|

| Mobile handsets (with public phone line) | 2,502.4 billion yen | 46.7 billion yen | 1.9% |

| Fixed communication equipment | 135.0 billion yen | 42.4 billion yen | 45.8% |

| LAN switches | 169.6 billion yen | 3.3 billion yen | 2.0% |

| Base station equipment | 219.0 billion yen | 2.1 billion yen | 0.9% |

| Facsimiles | 358.2 billion yen | 1.5 billion yen | 0.4% |

| Routers | 127.1 billion yen | 0.8 billion yen | 0.6% |

| Digital transmission equipment | 186.7 billion yen | 0.3 billion yen | 0.1% |

(1) Consumer equipment total: 2.502 trillion yen (+1.9% over FY2023)

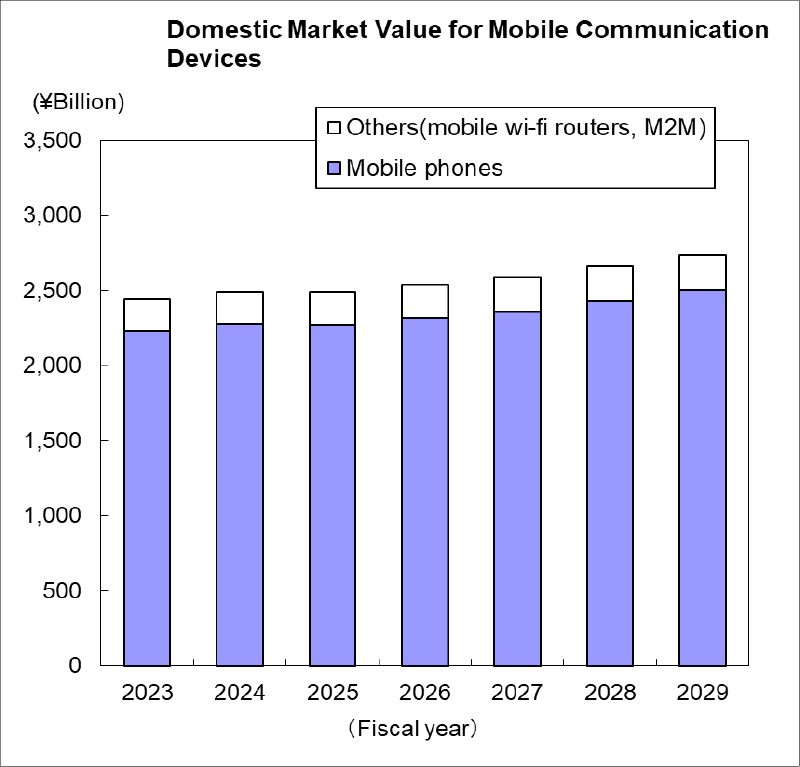

- Despite a decrease in the shipment of handsets due to a weaker yen and rising price of components leading to higher price tags that will cause consumers to hold back on new purchases and prolong replacement cycles, the domestic market value is expected to be higher.

(2) Enterprise equipment total: 424.8 billion yen (+0.1% over FY2023)

- Replacements are central to demand for key telephones, PBXs and office-use cordless phones and investments are shifting towards new work and communication styles. The close to complete elimination of supply restrictions is a positive factor, but the gradual restructuring of core corporate communications infrastructure contributes to the slight drop in the value of domestic demand.

- Changing work styles and the promotion of the switch to digital among private sector and government offices are expected to decrease demand for facsimiles (including multi-functioning facsimiles). Overseas demand for multi-functioning machines takes up a large share of facsimile demand value and like the situation in Japan, changes in work styles abroad is expected to have a negative impact. However, we predict a rebound from the drop in the previous fiscal year.

(3) Infrastructure equipment total: 540.7 billion yen (+9.0% over FY2023)

- Domestic demand for digital transmission equipment and base stations is forecast to remain flat after capital investment, mainly in 5G, by telecom carriers reached a peak in FY2022. With recovery from the semi-conductor shortage, demand for terrestrial fixed communication equipment for disaster-related emergency systems in the public sector is forecast to increase. Satellite fixed communication equipment is also expected to show positive growth.

- Exports are expected to rise as the recovery from the semi-conductor shortage makes it easier to procure parts and components for terrestrial fixed communication equipment and base station investments by overseas telecom carriers increase.

(4) Internet equipment total: 326.5 billion yen (+0.2% over FY2023)

- The investment cycle for higher speed networks during and following COVID-19 has subsided, leading to a forecast for lower demand for optical access equipment. Capital spending in routers is expected to rise to accommodate growing data traffic as telecom carriers expand cloud and other data services. Changes in work styles and the promotion of DX among private sector and government offices, as well as higher speed networks and high added value products for SOHOs are also forecast to have a positive impact. Demand for LAN switches will also grow as investments are made in network configuration changes to accommodate traffic growth and more devices connecting to the network. These trends will cumulatively result in growth in value of demand for this category.

(5) Equipment/parts categories not included above: 106.5 billion yen (-11.2% over FY2023)

III. Midterm Projection

The FY2029 total figure is projected at approximately 4.236 trillion yen (+10.5% growth over FY2023), with the domestic market accounting for about 3.944 trillion yen (+9.8% growth over FY2023) and exports accounting for 292.6 billion yen (+21.0% growth over FY2023).

Major Equipment Categories Forecast to Grow over FY2023 (In order of yen value growth)

| 【FY2024 Forecast】 | 【Increase over FY2023】 | 【Rate of growth】 | |

|---|---|---|---|

| Mobile handsets (with public phone line) | 2,752.2 billion yen | 296.5 billion yen | 12.1% |

| Base station equipment | 296.0 billion yen | 79.0 billion yen | 36.4% |

| Fixed communication equipment | 136.9 billion yen | 44.3 billion yen | 47.9% |

| Digital transmission equipment | 200.5 billion yen | 14.0 billion yen | 7.5% |

| LAN switches | 174.2 billion yen | 7.9 billion yen | 4.8% |

| Routers | 133.5 billion yen | 7.1 billion yen | 5.6% |

(1) Consumer equipment total 2.752 trillion yen (+12.1% over FY2023)

- The domestic demand for mobile handsets is forecast to show flat growth as replacement of 3G terminals will be mostly completed in FY2024. From FY2026 onwards, higher demand and steady growth for 5G handsets is forecast, as services utilizing 5G SA (Stand Alone) format allows simultaneous access by numerous devices at low latency and 5G unique services make their way onto the market.

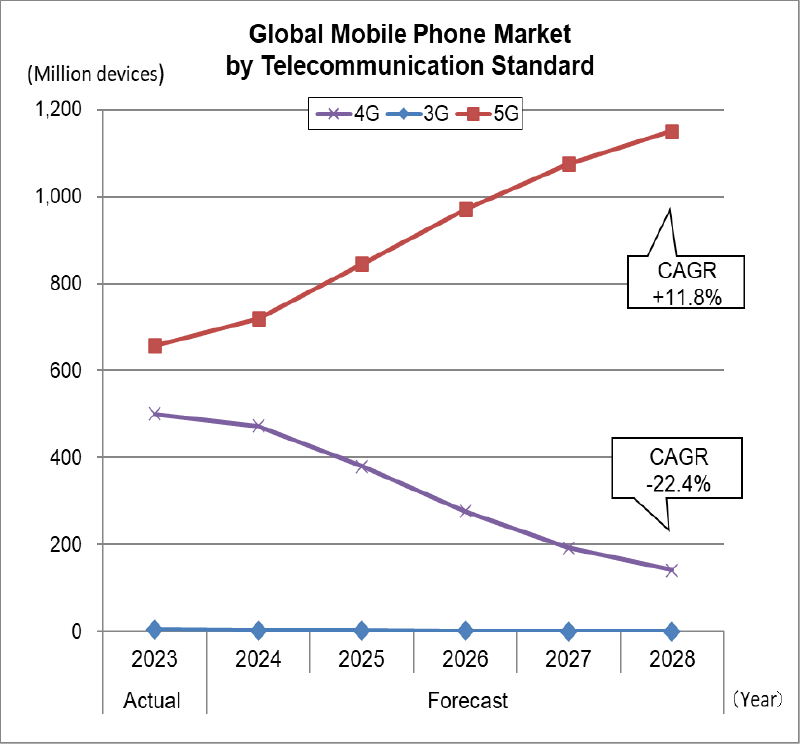

- The global mobile phone market (includes smartphones) in 2023 shrank with worsening uncertainty worldwide over geo-political circumstances combined with inflation, stunting consumption. The Chinese market is showing signs of recovery in the latter half of 2024, and the global economy is expected to improve from 2025 onwards, accounting for the projection for demand growth. With the majority of future smartphones expected to become 5G compatible, the 5G market will expand, while the non-5G smartphone market is expected to shrink.

(2) Enterprise equipment total: 369.7 billion yen (-12.8% over FY2023)

- Demand for key telephones, PBXs and office-use cordless phones will be affected by the restructuring of voice communication platforms at offices in connection with work style transformation and full adoption of cloud services, resulting in a continuous decline.

- The domestic market for office-use facsimiles (including multi-functioning facsimiles) will continue to decline with changes in work styles and the shift to digital at both private and public sector offices. Exports are also forecast to decrease for the same reasons as the domestic market.

(3) Infrastructure equipment total: 633.4 billion yen (+27.7% over FY2023)

- Among infrastructure equipment, demand for digital transmission equipment and base station equipment is expected to show gradual growth, as networks continue to be enhanced to accommodate the surge in traffic from 5G, local 5G, IoT services, and services incorporating generative AI. Demand for terrestrial fixed communication equipment is expected to grow from use in 5G radio backhaul and fronthaul and satellite fixed communication equipment demand is projected to increase from use in the public sector.

- Exports are expected to continue its growth with surging traffic and the building of new data centers.

(4) Internet equipment total: 338.9 billion yen (+4.0% over FY2023)

- Among Internet equipment, the market for routers will continue to grow to address traffic growth, replacement for more energy-efficient models and capital investments to strengthen security features. Growth is also projected for LAN switches with the surge in devices connected to the network as IoT/M2M evolves and services taking advantage of such advances emerge and full-scale 5G becomes more widely available. Demand for optical access equipment will be spurred by growing demand for large-volume contents and the pursuing use of high-speed services, as well as the need for offloading mobile data.

(5) Equipment/parts categories not included above: 127.0 billion yen (+5.8% over FY2023)

IV. Market Trends in New Businesses

(1) Background to the focus on new equipment and services

- In the past, the focus was on trends in telecom equipment used for providing fixed/mobile phone, ISDN, private leased circuit, and internet services. Telecommunication services, which used to be dedicated to providing a single type of service, have been impacted by technological innovations in ICT and the advancement of digital transformation (DX), leading to the combination of multiple services and solutions that are high-speed, large capacity, high value-added (low latency, multiple simultaneous connectivity, low power consumption, low cost, etc.) with the data processing power of AI and the storage capacity of the cloud. The base technologies that made this transformation possible relied on legacy communication technologies, but in recent years, virtual technologies are used in place of telecommunication equipment, with software running on general-purpose equipment, providing various combinations of features and technologies.