[ Overview ]

In FY2023, in the telecom market there was a recovery in business equipment for offices due to energized business activities, although shipments of certain equipment declined in reaction to their growth in the previous fiscal year. The domestic market of mobile phones shrank, reflecting weak demand and decreased domestic production due partly to business withdrawals, as well as restrained investment related to telecommunication infrastructure. In addition, exports of almost all types of equipment declined due to the global economic downturn.

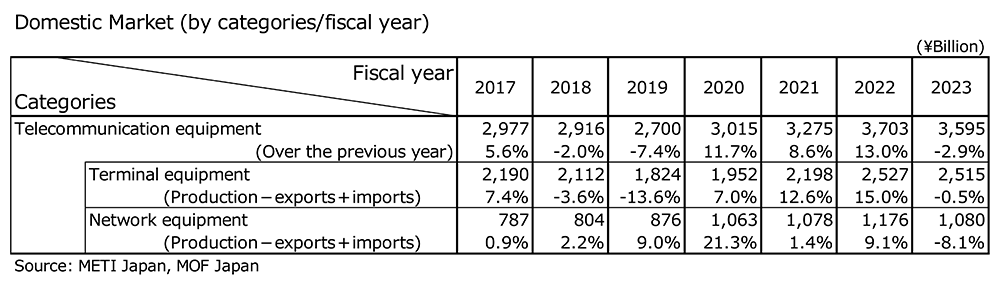

(1) Domestic Market Trends

The total value of the domestic market (value of domestic production – value of exports + value of imports; excluding parts) stood at 3,594.8 billion yen, down 2.9% year on year. The domestic market decreased for the first time in four years because the total value of the market of network equipment decreased for the first time in seven years due to the sluggish demand for digital transmission equipment and base stations.

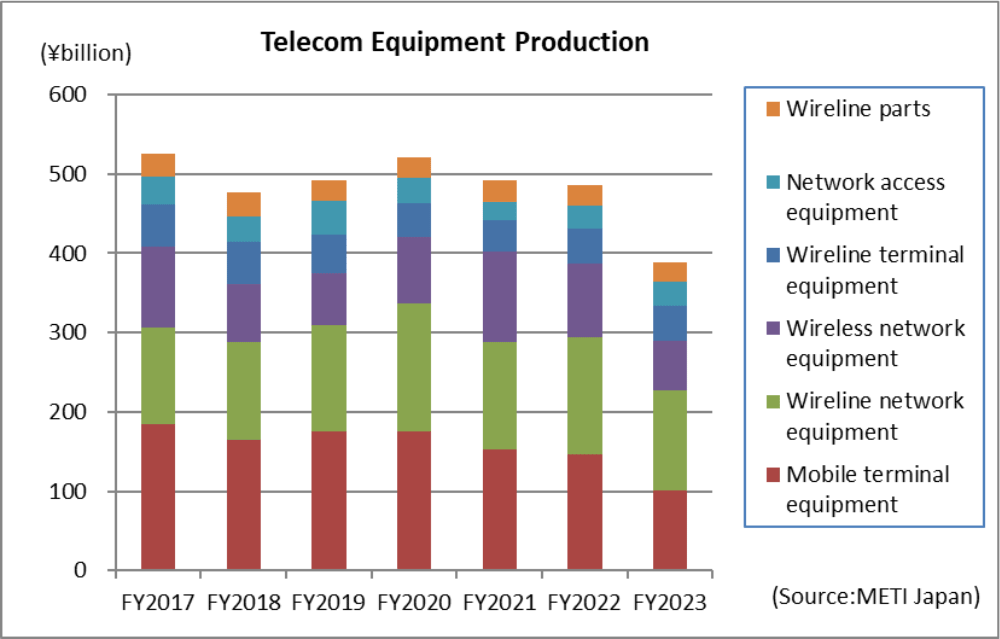

(2) Domestic Production Trends

The total value of domestic production was 389.1 billion yen, a year-on-year decrease of 20.0%. It has declined for three consecutive quarters. The production of wireline terminal equipment increased, reflecting a recovery from a decrease caused by the impact of supply restraints. However, the production of land telecommunication devices declined significantly, including mobile phones, an area domestic manufacturers continued to withdraw from. This resulted in a sharp decline in domestic production.

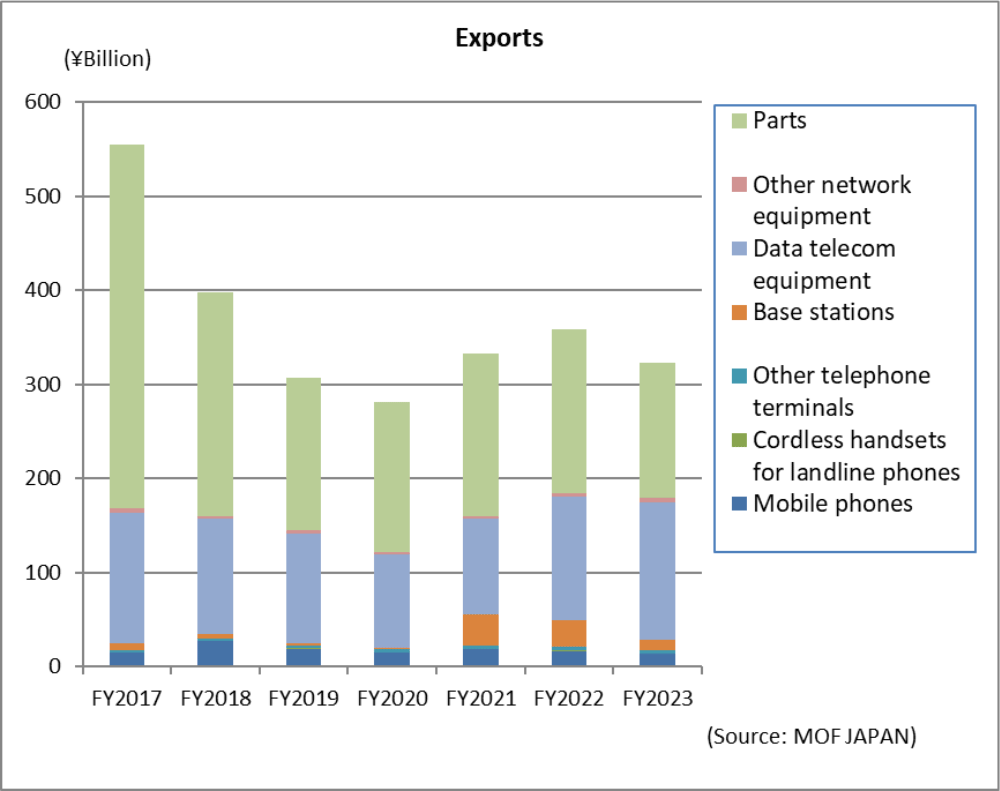

(3) Export Trends

Total exports amounted to 322.8 billion yen, a decrease of 9.8% year on year and the first time in three years there was a decrease. Exports for network equipment, which lead to an increase in traffic, rose partly due to the effect of the weak yen. On the other hand, the total value of exports decreased, reflecting a decline in exports for parts used for the production of smartphones due to the weakness of the global market, including China, where shipments for smartphones continued to fall as a result of the saturation of the number of subscribers and weak economic conditions.

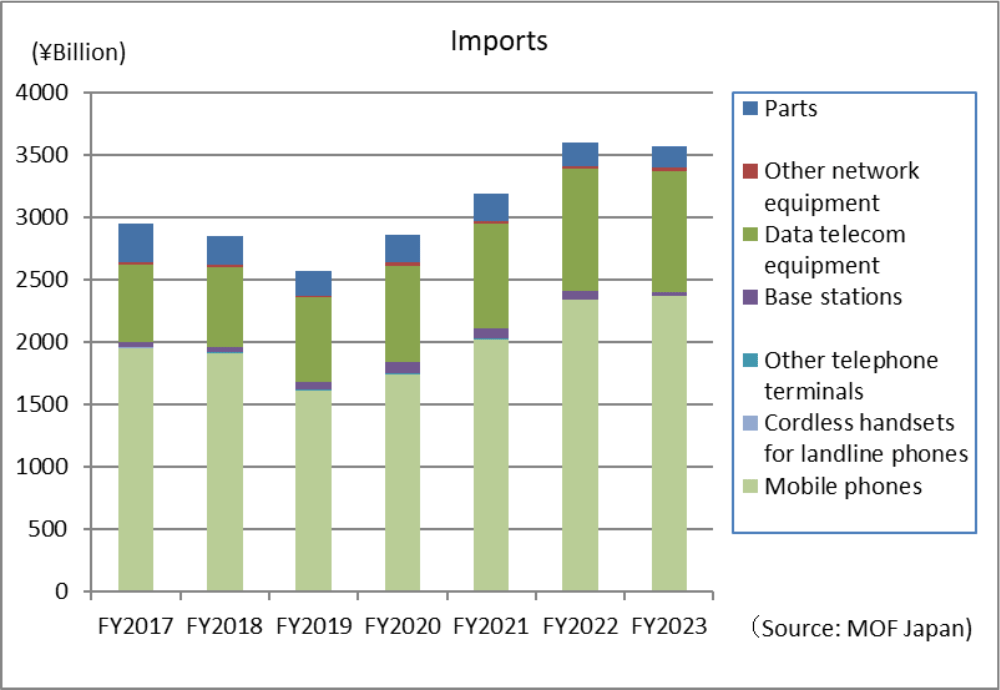

(4) Import Trends

Total imports amounted to 3,582.5 billion yen, a decrease of 0.8% year on year and the first decrease in four years. In mobile phones, while the number of imported units decreased due to extended replacement cycles, the value of imports increased backed by steady demand for high-priced models produced by overseas manufacturers. However, the total value of imports declined due to a decrease in investments in domestic telecommunication infrastructure equipment.

[ Orders Received and Shipped by Japan-based CIAJ Member Companies ]

Orders received and shipped came to 1,169.5 billion yen, down 25.5% year on year. Of this, the total value of domestic shipments was 941.4 billion yen, a decrease of 20.0% over FY2022. The total value of exports was 228.1 billion yen, a fall of 42.1% over FY2022. Domestic shipments dropped year on year, reflecting sluggish capital investment in telecommunication infrastructure equipment and other products. This was also partly due to a decline in shipments of certain types of equipment in reaction to the growth of demand in the previous fiscal year. Exports decreased year on year, reflecting weak demand for almost all types of equipment due to the global economic downturn.