The Communications and Information network Association of Japan (CIAJ) announces the telecommunication equipment production and trade figures for April through September, 2021 as follows.

I. Summary

In the Japanese economy during the six months between April and September 2021, private consumption, capital expenditure, and exports decreased due in part to the declaration of a state of emergency in response to the COVID-19 pandemic and the impact of a fall in production caused by a shortage of semiconductors. The annualized rate of real GDP growth (revised on December 8) for the July-September quarter was negative 3.6%, falling below zero for the first time in two quarters. Meanwhile, the telecom market began recovering from the weak demand and reduced business activities resulting from COVID-19. Demand for smartphones and communication infrastructure is growing in preparation for the 5G era, despite a decline in the production of certain models due to restrictions in parts supply.

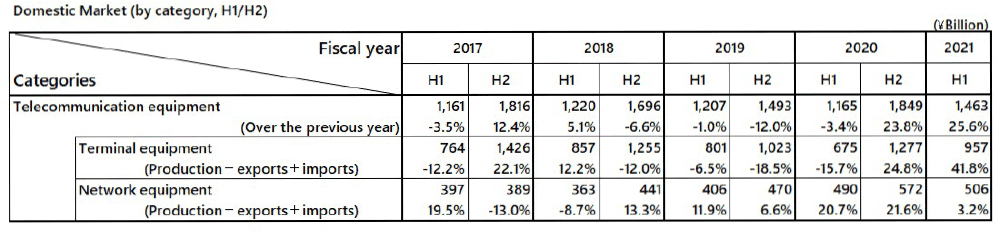

(1) Domestic Market Trends

The domestic market value (domestic production value – export value + import value, excluding components) amounted to 1,463.4 billion yen in the April through September period, a year-on-year increase of 25.6%. This was a result partly of an increase in import of mobile phones.

(2) Domestic Production Trends

Domestic production totaled 224.0 billion yen in the April through September period, a year-on-year increase of 0.6%. Domestic production grew slightly thanks to an increase in investment in 5G base stations, offsetting a fall in production in reaction to the addition of networks in the previous year and the impact of a decrease in production caused by restrictions on parts supply.

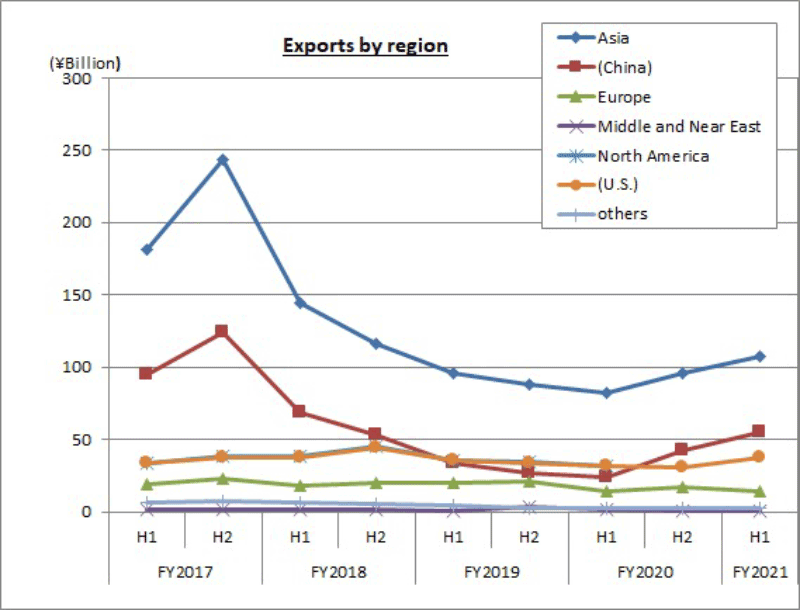

(3) Export Trends

Export totaled 163.4 billion yen, a year-on-year increase of 9.9%, in April through September. This was the first increase since the second half of FY2017. Smartphone production in emerging countries in Asia began to recover and the export of components for smartphone production increased. Other models decreased due to sluggish overseas economies.

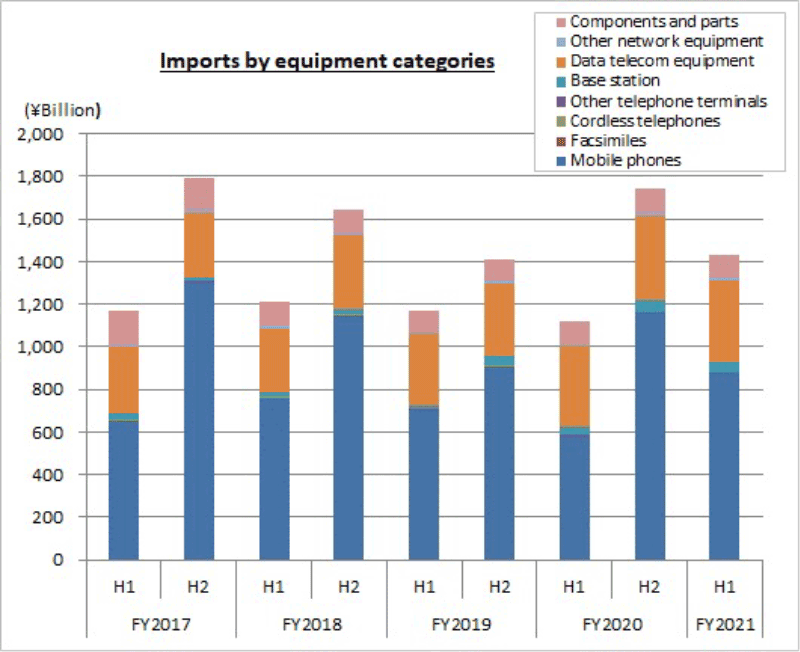

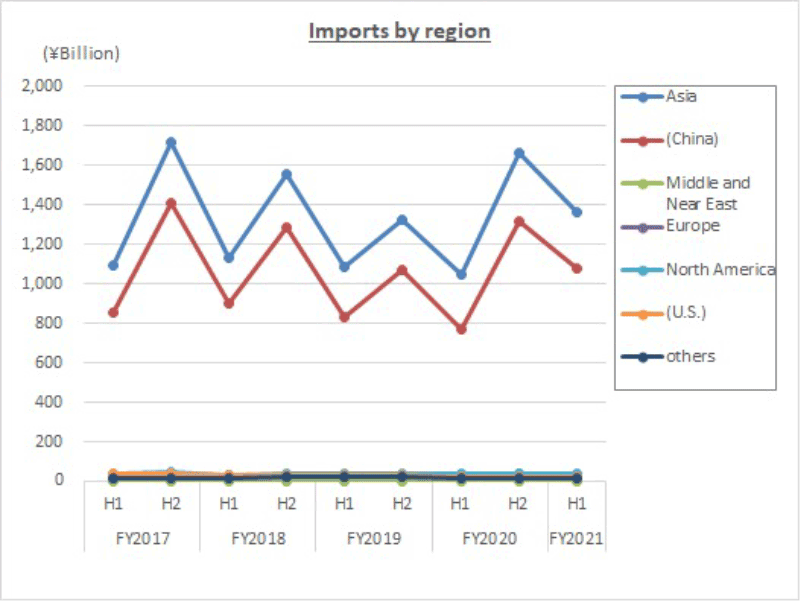

(4) Import Trends

In the April through September period, total imports amounted to 1,432.3 billion yen, a 27.8% increase year on year. Imports of mobile phones rose significantly from a fall in the previous year, thanks to an upward trend in domestic demand. Base stations and other data communication equipment (transmission equipment, communications equipment, modems, etc.) also increased.

II. Domestic Market Trends

(Aggregated by CIAJ based on Indices of Industrial Production and Trade Statistics of Japan)

(1) Detailed trends by category

Actual figures by category for FY2021 first half (H1) are as follows:

The size of the domestic market (including the value of imports of foreign brands) was calculated from government figures, the Indices of Industrial Production and Trade Statistics of Japan, according to the following formula: Domestic market size = value of domestic production – value of exports + value of imports.

Terminal equipment : 957.3 billion yen (+41.8% over the same period of the previous year)

Network equipment : 506.1 billion yen (+3.2% over the same period of the previous year)

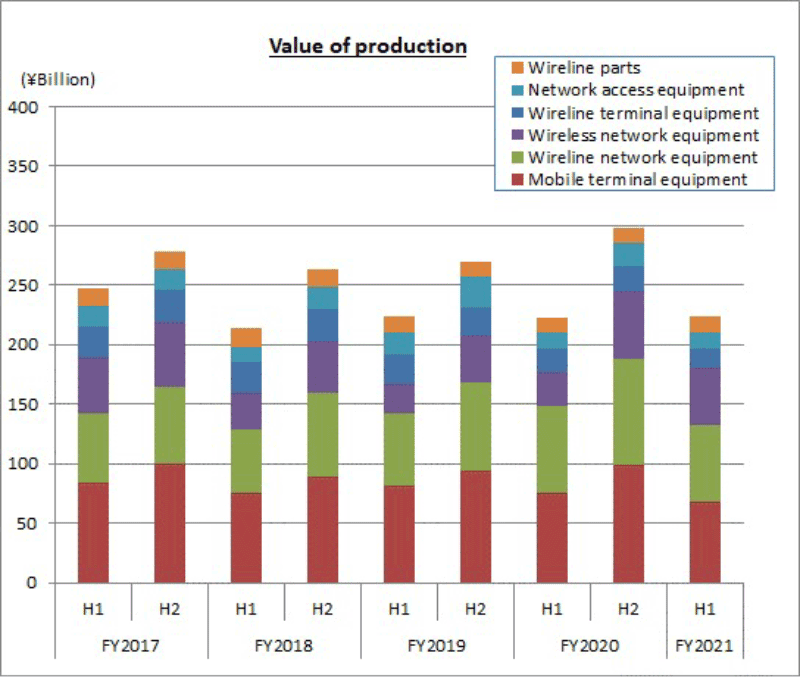

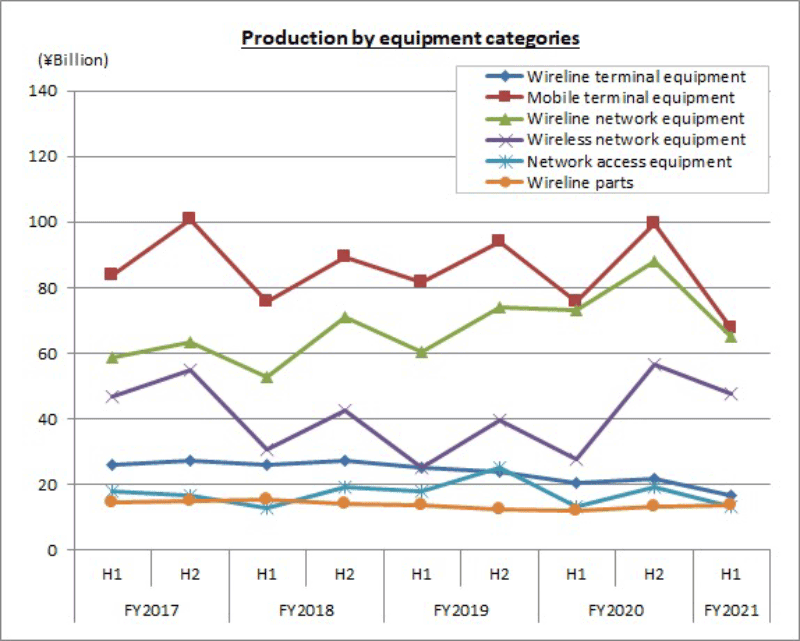

III. Domestic Production

(Aggregated by CIAJ based on Indices of Industrial Production compiled by the Ministry of Economics, Trade and Industry)

(1) Detailed trends by category

Actual figures by category for FY2021 first half (H1) are as follows:

Wireline terminal equipment

16.7 billion yen (-19.2% over the same period of the previous year). Of this, telephone sets was 0.7 billion yen (-17.4% over the same period of the previous year), key telephones 6.8 billion yen (+2.8%), and intercoms 9.2 billion yen (-30.3%). While progress in vaccination is encouraging sales activities and businesses are beginning to recover from the impact of COVID-19, domestic production of products such as intercoms is decreasing due to a delay in parts supply.

Mobile terminal equipment

67.8 billion yen (-10.4% over FY2020). Of which, mobile phones was 47.5 billion yen (-10.4% over the same period of the previous year). Domestic production of mobile phones and maritime and aeronautical mobile communications equipment also decreased with the impact of constraints such as limited parts supply.

Wireline network equipment

64.9 billion yen (-11.1% over FY2020). Of this, central office switching systems and private branch exchanges (PBXs) totaled 10.2 billion yen (-14.9% year on year), digital transmission equipment was 30.0 billion yen (-8.1% year on year), and other transmission equipment was 24.7 billion yen (-12.8% year on year). Domestic production of PBXs continuously decreased in part due to changes in people’s working styles triggered by COVID-19 in addition to limited parts supply. Domestic production of digital transmission equipment decreased largely due to a reactionary fall from the special demand for the GIGA School Program in the previous year.

Wireless network equipment

47.7 billion yen (+71.2% over the same period of the previous year). Of which, fixed telecommunication devices were 8.7 billion yen (-17.6% over the same period of the previous year) and base station equipment was 39.0 billion yen (+125.5% over the same period of the previous year). While domestic production of fixed communications equipment decreased due to sluggish demand for products for government offices, domestic production of base station communications equipment increased significantly thanks to the full-fledged construction of 5G communication infrastructure.

Network access equipment

13.1 billion yen (-2.1% over the same period of the previous year) . Domestic production decreased primarily due to limited parts supply despite growth in demand for products for government offices and private-sector companies.

Wireline parts (relays and repeaters for wired equipment)

13.8 billion yen (+14.5% over the same period of the previous year). Component production increased as export of components of smartphones manufactured overseas began to recover.

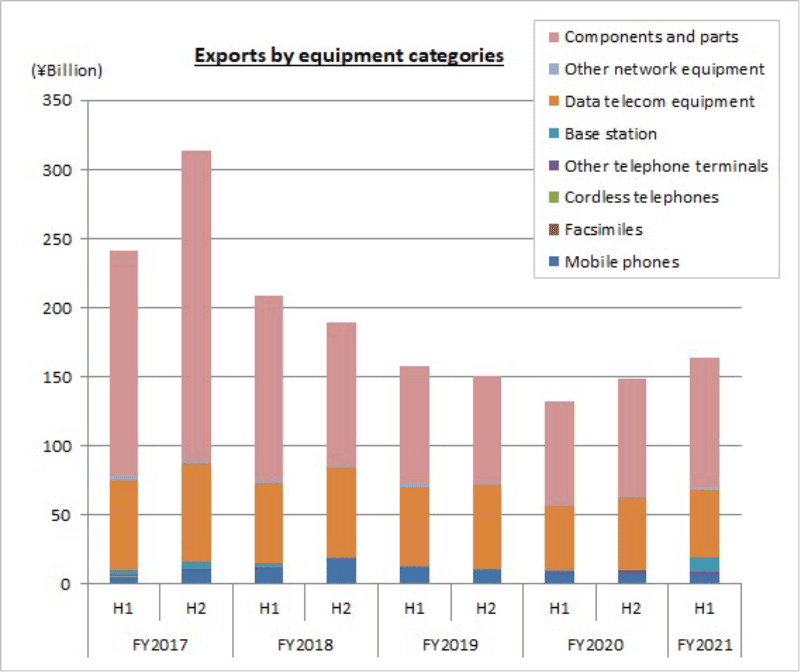

IV. Exports

(Compiled by CIAJ, based on Ministry of Finance’s “Trade Statistics”)

(1) Detailed trends by category

Actual figures by category for FY2021 H1 are as follows:

Telephone sets and terminal equipment 9.1 billion yen (-3.2% over the same period of the previous year).

Of this, mobile phones were 6.8 billion yen (-8.1% over the same quarter of the previous year), cordless handsets for landline phones were 0.04 billion yen (-68.8% over the same period of the previous year), and other was 2.2 billion yen (+21.4% over the same period of the previous year). Products such as simple radio telecommunication devices included in the other category increased.

Network equipment 60.5 billion yen (+10.7% over the same period of the previous year).

Of which, base stations was 9.9 billion yen (+1215.2% over the same period of the previous year), data communication equipment was 49.2 billion yen (-5.9% over the same period of the previous year) and other network equipment was 1.4 billion yen (-12.5% over the same period of the previous year). Export of base stations to the U.S. significantly increased through global business deployment.

Parts (both wireline and wireless) 93.8 billion yen (+10.9% over the same period of the previous year)

Overseas smartphone production began to recover and export of components for smartphone production increased.

(2) Detailed trends by region

The results by region for the April-through-September period include 107.1 billion yen for Asia (+11.2% year on year), in which exports to China totaled 55.3 billion yen (+31.1% year on year).

North America was 38.5 billion yen (+21.1% over the same period of the previous year), of which the U.S. was 37.7 billion yen (+21.3% over the same period of the previous year).

Europe was 14.6 billion yen (-12.8% over the same period of the previous year), of which the EU was 10.8 billion yen (-3.7% over the same period of the previous year).

Export of components increased in line with the recovery of the Chinese economy. Export of base stations to the U.S. and Europe increased through global business deployment.

(3) Comparison and breakdown by region

| First: | Asia | 65.5% (+3.5% over the same period of the previous year) |

| Second: | North America | 23.5% (-0.8% over the same period of the previous year) |

| Third: | Europe | 8.9% (-1.9% over the same period of the previous year) |

| Other regions | 1.6% (-0.8% over the same period of the previous year) |

V. Imports

(Compiled by CIAJ, based on Ministry of Finance’s “Trade Statistics”)

(1) Detailed trends by category

Actual figures by category for FY2021 H1 are as follows:

Telephone sets and terminal equipment 881.9 billion yen (+50.0% over the same period of the previous year).

Of which, mobile phones was 877.3 billion yen (+50.7% over the same period of the previous year), cordless handsets for landline phones was 2.0 million yen (-11.5% over the same period of the previous year), and other was 2.6 million yen (-28.6% over the same period of the previous year). Import of mobile phones grew substantially year on year thanks to the gradual recovery of demand in contrast to the condition in the same period of the previous year and difference in the month of releasing new products of overseas smartphone manufacturers.

Network equipment 440.8 billion yen (+3.8% over FY2020)

This includes 49.8 billion yen for base stations (+32.7% over the same period of the previous year), 380.5 billion yen for data communication equipment (+0.7% over the same period of the previous year), and 10.6 billion yen for other network-related equipment (+11.5% over the same period of the previous year). Import of “other products (transmission equipment, communications equipment, modems, etc.)” in data communication equipment continued to increase due to capital expenditure for networks.

- Parts (both wireline and wireless) 109.5 billion yen (+1.4% over the same period of the previous year)

(2) Detailed trends by region

A breakdown of results for April through September by region shows that Asia was 1,363.5 billion yen (+30.6% over the same period of the previous year), of which China was 1,749.0 billion yen (+39.2% over the same period of the previous year). North America was 22.1 billion yen (-22.3% over the same period of the previous year), of which the U.S. accounted for 20.2 billion yen (-22.4% over the same period of the previous year). Europe was 30.5 billion yen (-1.6% over FY2020), of which the EU was 29.3 billion yen (-2.2% over FY2020). Import has been decreasing due to sluggish overseas production except an increase in the import of mobile phones.

(3) Comparison and breakdown by region

| First: | Asia | 95.2% (-0.4% over the same period of the previous year) |

| Second: | North America | 1.5% (+0.1% over the same period of the previous year) |

| Third: | Europe | 2.1% (+0.1% over the same period of the previous year) |

| Other regions | 1.1% (+0.2% over the same period of the previous year) |

VI. Trends in Orders Received and Shipped

(1) Results for the first half of FY2021 (April through September 2021)

CIAJ statistics for total orders received and shipped in April through September amounted to 670.2 billion yen, representing a decrease of 1.5% year on year. This includes 530.7 billion yen for domestic shipments, which fell by 3.1% year on year, and 139.5 billion yen for exports, which dropped 23.3% year on year.

*Orders received and shipped by CIAJ member companies (domestic manufacturers) = value of domestic production + value of imports produced overseas = domestic shipment + export value

(2) Trends by category

Actual figures by category for FY2021 H1 are as follows:

Wireline terminal equipment 213.8 billion yen (-2.0% over the same period of the previous year)

Orders received and shipment of telephone sets, intercoms, and office-use cordless handsets began to recover from the impact of COVID-19, and domestic demand increased. Meanwhile, a recovery in personal facsimiles (include multifunction printers) and business facsimiles (including multifunction printers) slowed with the impact of parts shortages such as semiconductors on the supply side despite an upward trend in demand. As a result, wireline terminal equipment as a whole decreased year on year.

Mobile terminal equipment 197.1 billion yen (+0.5% over the same period of the previous year)

While demand for mobile phones began to recover thanks to an increase in purchasing opportunities, sales grew only slightly due to a fall in produce prices. Shipment of other mobile terminal equipment was sluggish both in Japan and abroad.

Wireline network equipment 89.9 billion yen (-18.9% over the same period of the previous year).

While demand for business equipment such as key telephones and private branch exchanges is beginning to recover along with progress in vaccination and an increase in sales activities, shipments have been decreasing due mainly to a delay in parts supply.

Moreover, digital transmission equipment and PON/MC decreased in part due to a reactionary fall from the maintenance of optical cable networks across the country, including the GIGA School Program, in the previous year and shipment decreased in overall wired network equipment.- Wireless network equipment 133.7 billion yen (+25.7% over the same period of the previous year).

Demand for fixed communications equipment decreased in sectors other than export of terrestrial products and satellite products for the private sector. Fixed communications equipment increased significantly both in Japan and for export as investment in base station communications equipment for 5G mobile phones grew to full scale. Shipments of overall wireless network equipment increased year on year.

- Other network equipment 17.3 billion yen (+4.8% over the same period of the previous year).

Demand for routers and LAN switches is growing as products for the private sector such as datacenters and for the public sector.

- Communication equipment parts 18.5 billion yen (+46.1% over the same period of the previous year)