The Communications and Information network Association of Japan (CIAJ), a general incorporated association, released its “Mid-Term Demand Forecast for Telecommunication Equipment,” covering FY2021 through FY2026.

I. Outline

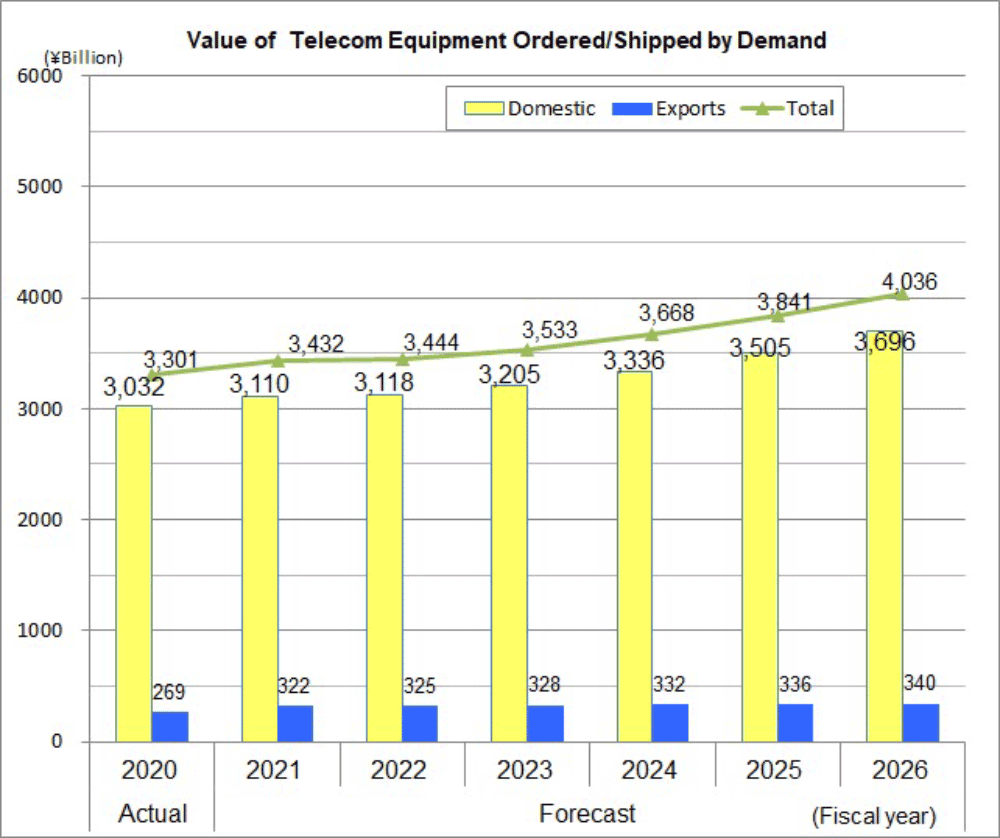

Despite the significant slowdown of the Japanese economy in FY2020 due to the COVID-19 pandemic, greater investment in telecommunication infrastructure to accommodate the surge in traffic from telework and remote learning during the state of emergency, demand for mobile devices as the end of 3G service approaches and the switch to 5G handsets all led to the total demand for telecom equipment in FY2020 of 3.301 trillion yen (+2.9% year-over-year growth).

Japan’s measures to curb the spread of the virus, such as widespread vaccinations, contributed to signs of resumption of economic activities in FY2021. In the telecommunication equipment market, risk factors, such as disruptions in the supply chain and shortages in semiconductors exist, but the rise in traffic from the promotion of digital transformation (DX) and installation of 5G base stations gains momentum, with the total demand for telecom equipment in FY2021 forecast at 3.432 trillion yen (+4.0% year-over-year growth).

The ICT industry from FY2022 onwards will take advantage of COVID-19 measures to meet diverse social needs – the continuation of everyday life, such as commuting to work and attending school, undisrupted business, such as manufacturing and sales activities – if and when another pandemic or natural disaster occurs. This will be realized in the form of providing new 5G, beyond 5G/6G and/or AI info-communication terminals and services to the market, which, in turn, will require communication infrastructure, including optical transmission, to process the rise in data traffic. This evolution will further promote digitalization that will lead to greater economic growth and productivity for the entire society. The total telecom equipment market value is expected grow to 4.362 trillion yen in FY2026, or an increase of 22.3% over the FY2020 figure.

II. 2021 Forecast

The total telecommunication equipment market figure for FY2021 is forecast at approximately 3.432 trillion yen (+4.0% year-over-year growth), with the domestic market accounting for 3.110 trillion yen (+2.6% year-over-year growth), and exports accounting for 322.4 billion yen (+19.7% year-over-year growth).

| FY2021 (expected) (billion yen) | Increase over FY2020 (billion yen) | Growth rate | |

|---|---|---|---|

| Base station equipment | 296.0 | 70.2 | 31.1% |

| Mobile communication terminals (public network use) | 1902.6 | 51.9 | 2.8% |

| Fixed communications equipment | 160.1 | 29.9 | 22.9% |

| Routers | 113.7 | 3.3 | 3.0% |

| Central office switching systems | 0.2 | 0 | 589.7% |

(1) Consumer equipment total: 1.938 trillion yen (+2.6% over FY2020)

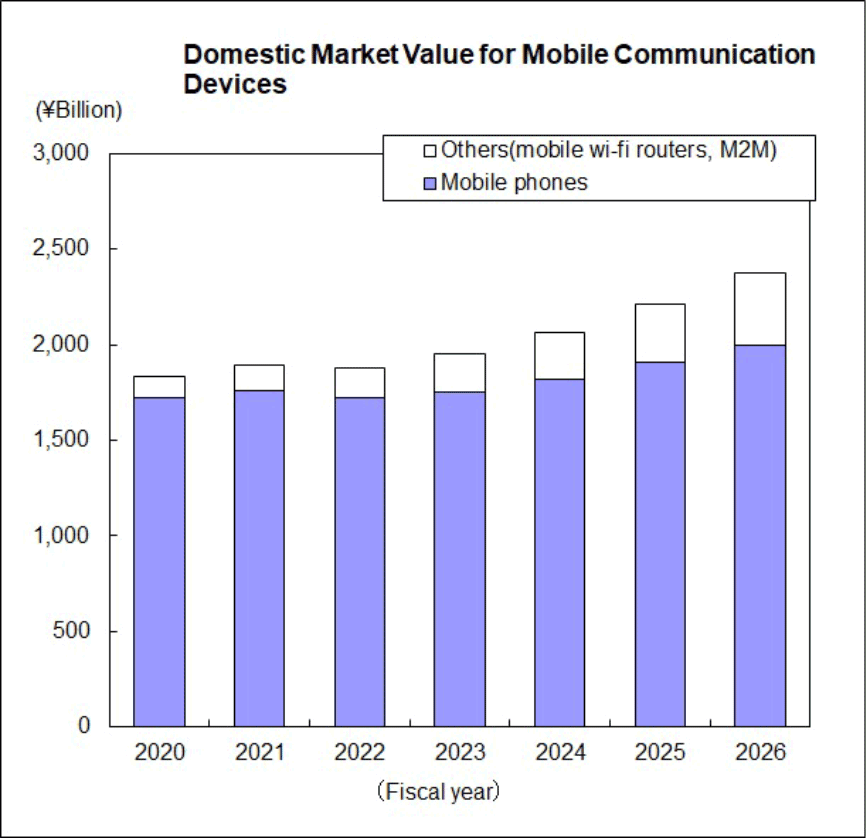

- Despite concerns over longer replacement cycles and the shortage of semiconductors, the switch from 3G handsets and growth in 5G handset purchases are expected to fuel demand for mobile communication devices.

- Steady demand among older adults for cordless phones and personal facsimiles (including multi-functioning facsimiles) continues but will not be enough to reverse the overall downward trend. Value-added features include enhanced capacity for blocking unwanted telemarketing calls or assisting in identifying calls from scam artists.

(2) Enterprise equipment total: 402.5 billion yen (-3.3% over FY2020)

- Replacements are central to demand for key telephones, PBXs and office-use cordless phones and new workstyles accelerated by the COVID-19 pandemic and the shortage in semiconductors will continue to decrease demand.

- Overseas demand takes up a large share of office-use facsimiles (including multi-functioning facsimiles) and with the negative impact of COVID-19 on overseas economies, demand is forecast to continue shrinking.

(3) Infrastructure equipment total: 615.8 billion yen (+18.1% over FY2020)

- Installation of base stations and fixed communication equipment is expected to resume after postponement in FY2020 due to the COVID-19 pandemic. Investments to accommodate the surge in traffic from new life and workstyles as well as for 5G services will also fuel demand in this category.

- Demand for digital transmission equipment is forecast to revert to negative growth after increasing in FY2020 from nation-wide optic fiber cable networks laid down for the government’s GIGA (Global and Innovation Gateway for All) School Program to make high-speed networks available to every student.

(4) Internet equipment total: 326.4 billion yen (+0.6% over FY2020)

- The surge in traffic stemming from demand for large-volume contents, replacement demand for old equipment and changes in workstyle from the COVID-19 pandemic has translated into a demand increase, but supply limitations for LAN switches and optical access equipment due to the semiconductor shortage has led to a negative growth figure for the overall category.

(5) Equipment/parts categories not included above: 148.9 billion yen (-0.4% over FY2020)

III. Midterm Projection

The FY2026 total figure is projected at 4.362 trillion yen (+22.3% growth over FY2020), with the domestic market accounting for 3.696 trillion yen (+21.9% growth over FY2020) and exports accounting for 340.0 billion yen (+26.3% growth over FY2020).

| FY2026 (expected) (billion yen) | Increase over FY2026 (billion yen) | Growth rate | |

|---|---|---|---|

| Mobile communication terminals (public network use) | 2383.9 | 533.2 | 28.8% |

| Base station equipment | 458.3 | 232.5 | 103.0% |

| Fixed communications equipment | 165.7 | 35.4 | 27.2% |

| LAN switches | 202.4 | 11.7 | 6.1% |

| Digital transmission equipment | 174.3 | 8.9 | 5.4% |

| Routers | 115.8 | 5.5 | 5.0% |

| Optical access equipment | 23.7 | 0.3 | 1.4% |

| Central office switching systems | 0.2 | 0.2 | 589.7% |

(1) Consumer equipment total 2.409 trillion yen (+27.5% over FY2020)

- The domestic demand for mobile communication terminals is forecast to show significant growth with replacement of 3G handsets, new 5G service-compatible devices coming on the market – adding to the yen-value of the market, demand for non-contact systems with the spread of COVID-19 and popularity of IoT leading to greater use of IoT/M2M (Machine to Machine) modules – adding to the number of units for the category. However, lower unit prices for 5G handsets from FY2022 is expected to decrease the market value.

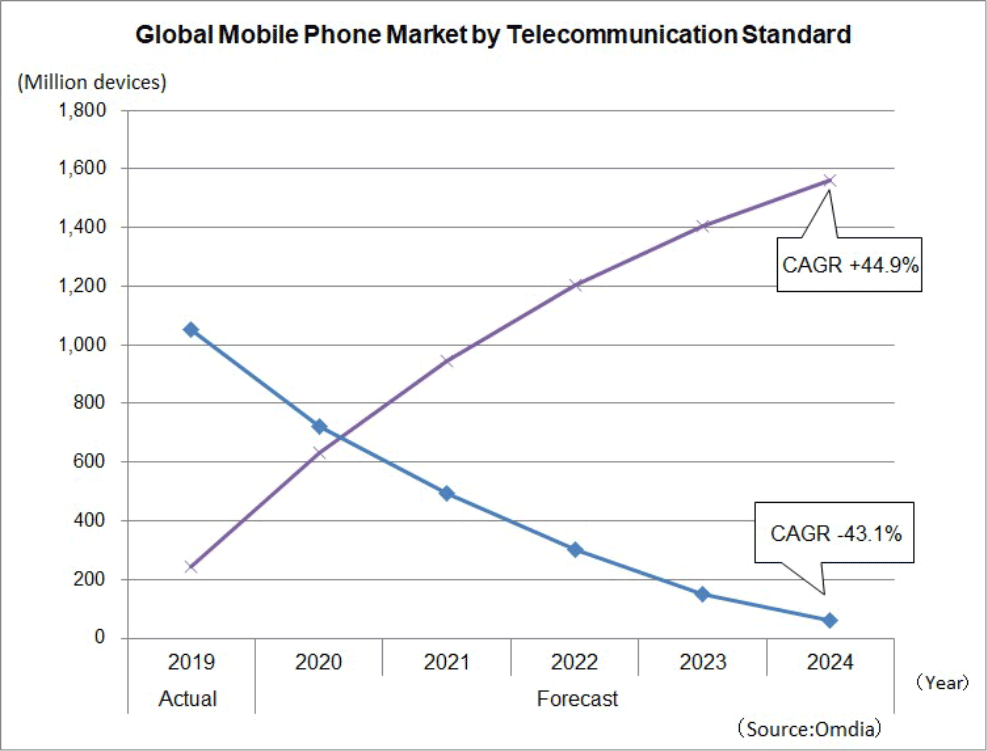

- The global mobile phone market (includes smartphones) is expected to record positive growth into FY2025. Global recovery from COVID-19 is projected in FY2021 and though semi-conductor shortages will negatively impact the latter half of FY2021, supply is seen to increase in FY2022. In addition, demand for 5G handsets, especially in developed countries, and continuing shifts from feature phones to smartphones among emerging markets resulted in the positive outlook. However, the maturing of emerging markets and price cuts in 5G handsets is expected to lead to a more tapered growth curve from FY2022. The sales revenue in FY2025 is projected at 435.6 billion U.S. dollars (CAGR +4.5%).

- Overall demand for cordless phones and personal facsimiles (including multi-functioning facsimiles) is forecast to continue declining with fewer fixed telephone lines and shrinking use of information dissemination using paper medium.

(2) Enterprise equipment total: 337.4 billion yen (-18.9% over FY2020)

- Key telephones, PBXs and office-use cordless phones are forecast to decline as the COVID-19 pandemic fast forwards workstyle transformation, with corporations rebuilding alternative voice communication platforms, such as cloud PBX and FMC services.

- The domestic market for office-use facsimiles (including multi-functioning facsimiles) will continue to decline as shifts to other communication channels such as e-mail result in less use and longer replacement cycles as well as workstyle innovations requiring less in-office work and thus, smaller office spaces.

(3) Infrastructure equipment total: 798.5 billion yen (+53.1% over FY2020)

- Demand for digital transmission equipment and terrestrial fixed communication devices will grow as networks are enhanced to accommodate the surge in traffic from 5G and IoT services, the popularity of heavy content streaming services, such as 4K/8K, as well as the robust demand for high speed & high-capacity data centers and disaster information systems.

- Exports are expected to climb in FY2021 and show healthy growth thereafter. This is partly due to telecom carriers abroad moving away from relying on single vendor procurement to reduce dependency risks.

(4) Internet equipment total: 342.0 billion yen (+5.4% over FY2020)

- Demand for routers, LAN switches and optical access equipment is forecast to grow. Underlying factors include rising traffic from 5G services, uptake in IoT/M2M, building new or expanding existing data centers and growth of high-speed services delivering data-heavy contents. Negative factors include lower unit/port prices from fierce price competition, virtualization using general-purpose hardware and replacement by 5G services, but these will be out-weighed by the embracing of DX brought about by workstyle innovations fueled by COVID-19.

(5) Equipment/parts categories not included above: 149.1 billion yen (-0.4% over FY2020)

IV. Market Trends and New Equipment/Services

(1) Summary

- Past mid-term demand forecasts focused on trends in telecom equipment for fixed & mobile phone networks, ISDN, private leased circuit and the internet.

- It will be necessary to look not only at telecom equipment-centric hardware, but also advances in optic and quantum technologies as well as software-centric aspects such as in cloud and virtualization technologies, which increasingly drive market trends.

- Widening the scope of the forecast is due largely to advances in virtualization technologies. In the past, dedicated telecom equipment was needed to provide telecom services and functions but advances in virtualization and the emergence of software to take on the same role with general-purpose equipment (mainly servers) has changed the landscape.

- Future forecasts will broaden its scope to capture trends of new equipment and services with growth potential, which will include general-purpose equipment for virtualization software systems.

(2) Examples of equipment and services to be covered

- Infrastructure/internet categories for both consumer and enterprise: terabit-level optical transmission equipment, virtual (cloud) base stations, edge data centers, satellite constellation, IoT solutions (autonomous driving, security, decarbonizing/carbon neutral), building virtualization platforms/operational support services, virtual routers/switches, solutions using quantum cryptography communication and AI.

- Consumer: personal xR devices (VR: virtual reality, AR: augmented reality, MR: mixed reality), consumer stationary mobile routers, home robots, home voice-response/network solutions.

- Enterprise: business-use xR devices (VR: virtual reality, AR: augmented reality, MR: mixed reality), business-use stationary mobile routers, business-use robots, business-use IoT/local 5G solutions (for factories, logistics, transportation, agriculture, lumber, fishery, etc.), unified communications/collaboration.

- Explain market trends for the above equipment and service categories.

[Forecasting methodology]

Domestic market forecasts are based on statistics compiled by CIAJ and interviews with CIAJ members, with the cooperation of InfoCom Research, Incorporated, for areas not covered by CIAJ.

Global ICT market forecasts and demand trends refer to and utilize data and analysis provided by a global research company Omdia with the cooperation of InfoCom Research, Incorporated.